MTAA Calls For Savings To Be Passed On To Consumers

The Medical Technology Association of Australia (MTAA) has called for greater transparency and controls on corporate health insurers to ensure savings are passed on to consumers.

Data released today by the Australian Prudential Regulator Authority (APRA), revealed benefits paid by insurers for medical devices on the Prostheses List have continued to drop.

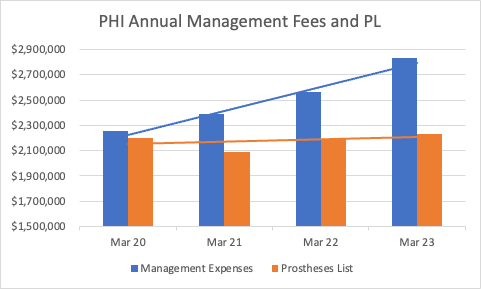

MTAA CEO, Ian Burgess, said the data showed Prostheses List reforms were continuing to deliver significant savings to health insurers, which now total more than $2.1 billion since 2017.

“What we are seeing is a continued decline in the benefit levels for medical devices, delivered by the MedTech industry, but which are yet to be passed on to consumers by corporate health insurers in full,” Mr Burgess said.

“Despite the increase in utilisation, APRA’s data shows that the total benefits paid for medical devices dropped by 8.9% in March 2023, compared to December 2022 – a clear result of the ongoing reforms to the Prostheses List.

“The MedTech industry is continuing to play its part to help ease cost-of-living pressures for Australians, it’s well time a mechanism was introduced by government to compel corporate insurers to pass on the savings, delivered by our industry, to consumers.”

Quarterly APRA data has revealed that while corporate health insurers paid less for medical devices, insurers have again increased their management expenses by more than $29 million, up 4.3% over the last quarter. The APRA data also showed, in this quarter, health insurers spent $184 million more on management expenses than on medical devices for patients. In the year ended March 2023, insurers spent $600 million more on management fees than on medical devices.